This is a link to a spreadsheet to help determine which funds to place into taxable vs tax-advantaged space.

Here is a link to the Bogleheads wiki about tax-efficient fund placement:

If all else is equal, international funds have a small tax advantage over US funds, because they are eligible for the foreign tax credit.

TL;DR:

- put international funds in taxable and file for the foreign tax credit each year

- the total difference is like 0.1-0.2%, so optimizing fees may be more impactful than going through this exercise

This wasn’t good enough for me, especially as I’m looking into applying a small-cap tilt to my portfolio and really like optimizing things, so I went digging for more information.

Foreign Tax Credit

When you own stocks or otherwise make money in another country, that other country may charge taxes, and the IRS will also charge taxes on any dividends you receive, regardless of source. This ends up in double taxation, because you’re being taxed on your dividends by both the US and the foreign country.

To eliminate the double taxation, you can file form 1116 to recoup the foreign taxes by getting a credit (or deduction, but that’s rarely better). This Bogleheads wiki doc has more information if you want it.

For many funds (e.g. VXUS), the FTC ends up being something like 0.25%, so if it’s in a tax-advantaged account, you’d end up with a 0.25% tax drag on your investments due to foreign taxes you can’t recoup.

Tax-efficiency

When deciding where to place funds, you generally want fewer dividends and capital gains in your taxable brokerage accounts and to put the higher dividend-yielding assets in your tax-advantaged accounts. And if you have to have capital gains, you want to make sure your taxable account has mostly qualified capital gains so they’re taxed at the long-term capital gains rate instead of the (in most cases) higher income tax rate.

However, the foreign tax credit changes things, since you can only get it if your investments are in a taxable brokerage account. There are cases where you’d prefer a higher total dividend in your taxable account provided the tax credit more than makes up for the difference in total taxes.

Worked example w/ VTI and VXUS

For example, let’s say you have equivalent amounts of VXUS and VTI. VXUS has 3.34% total dividend yield whereas VTI has 1.66% (both as-of 2021). So you’d want VXUS in tax advantaged and VTI in taxable, right? Wrong. The total taxes for both are:

- VXUS - 0.56%, of which 0.26% is recoverable foreign taxes, for a net of 0.30%

- VTI - 0.32%

Here are two scenarios (assuming you have no state income tax, are in the 22% bracket w/ 15% LTCG):

- VTI in taxable - VXUS pays 0.26% in foreign taxes, for a total tax bill of 0.26%

(0.26% + 0.26) / 2 - VXUS in taxable - 0.30% net taxes (

0.56% - 0.26%), for a total tax bill of 0.15% (0.30% / 2)

So in this case, holding VXUS in taxable saves about 0.11% in total taxes paid.

Added notes

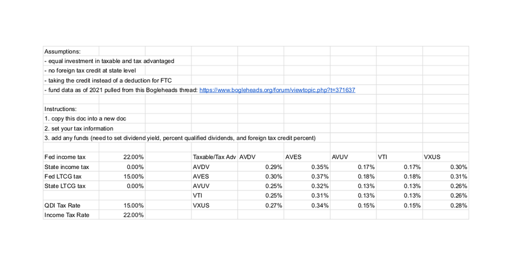

I added some Avantis funds (known for value funds) on here that are interesting:

- AVUV - US small-cap value fund

- AVDV - developed markets small-cap value fund

- AVES - emerging markets value fund

So please, make a copy and mess around with your own figures. You can add some funds as well if you like, just fill in the bolded sections in the “funds” tab and it should work for you.

I’d appreciate a second pair of eyes as well if you feel so inclined.

Anyway, do you bother with adjust fund placement?

Great analysis! I do some basic tax efficient placement, but don’t overly worry about it. I keep my bond funds in my 401k, tradIRA, and HSA. Stock funds only in my Roth IRA and taxable. I do have some international stocks in my retirement accounts, but I do get a decent amount back in foreign tax credit due to my taxable holdings as well.