Username checks out.

And maybe not even that much ‘fun’ as it landed as a cat3 rather then 5, so might be bad but not horrific. Also valid point on being prepared. The ultimate preppers, who follow orders, and have a plan even if it doesn’t last.

The video used knots and meters. So 66.21 kn and 8.57m.

Saildrones aren’t intended as a hurricane monitoring platform. The marine work I am most aware of them used for is multibeaming the seafloor, so my reaction as a seafarer on a research vessel is, “it survived?!?!?” (Also which model?). That’s a sea state 7 and Beaufort of 9.

Which should answer your question that yes, there are not much in the way of other data points like this. There might be some other NOAA floats, buoys, and some vessels with weather station data which can report, but having an unscrewed vessel like Saildrone is just starting to be used. Marine research doesn’t have the military budgets to just throw things at storms.

Perhaps this should be decreed in a new Geneva convention as the only allowed long range missile system? That would make wars less deadly and more useful.

Currently, Tesla is the leading company in the first release of the Battery StorageTech Bankability Ratings report, and is the only supplier to feature in the top AAA-Rating band.

While Tesla relies upon some third-party battery cell supply, the quarterly deployment levels of ESS solutions are currently trending at record highs (almost 10 GWh). Furthermore, Tesla’s Financial Scores are at the upper end of all the companies analyzed in the first report, although ESS operations still represent a minor part of the total group turnover.

Over the next 12 months, it is expected that significant changes will unfold in the Bankability Pyramid; in particular, arising from the number of new Chinese companies that have entered the sector in the past couple of years. However, it is unclear how the fortunes of these producers will evolve since many of them are largely ‘China-centric’ in their positioning and lack any manufacturing capacity outside mainland China.

Ultimately, the sector could become segmented in geographic supply coverage, driven by US/China trade policy or the realignment of EV/ESS upstream manufacturing to satisfy the geographic location-of-manufacturing demands from the EV industry globally.

Say more please? What’s the advantage?

People are doing work to figure out how bad the famine will be..

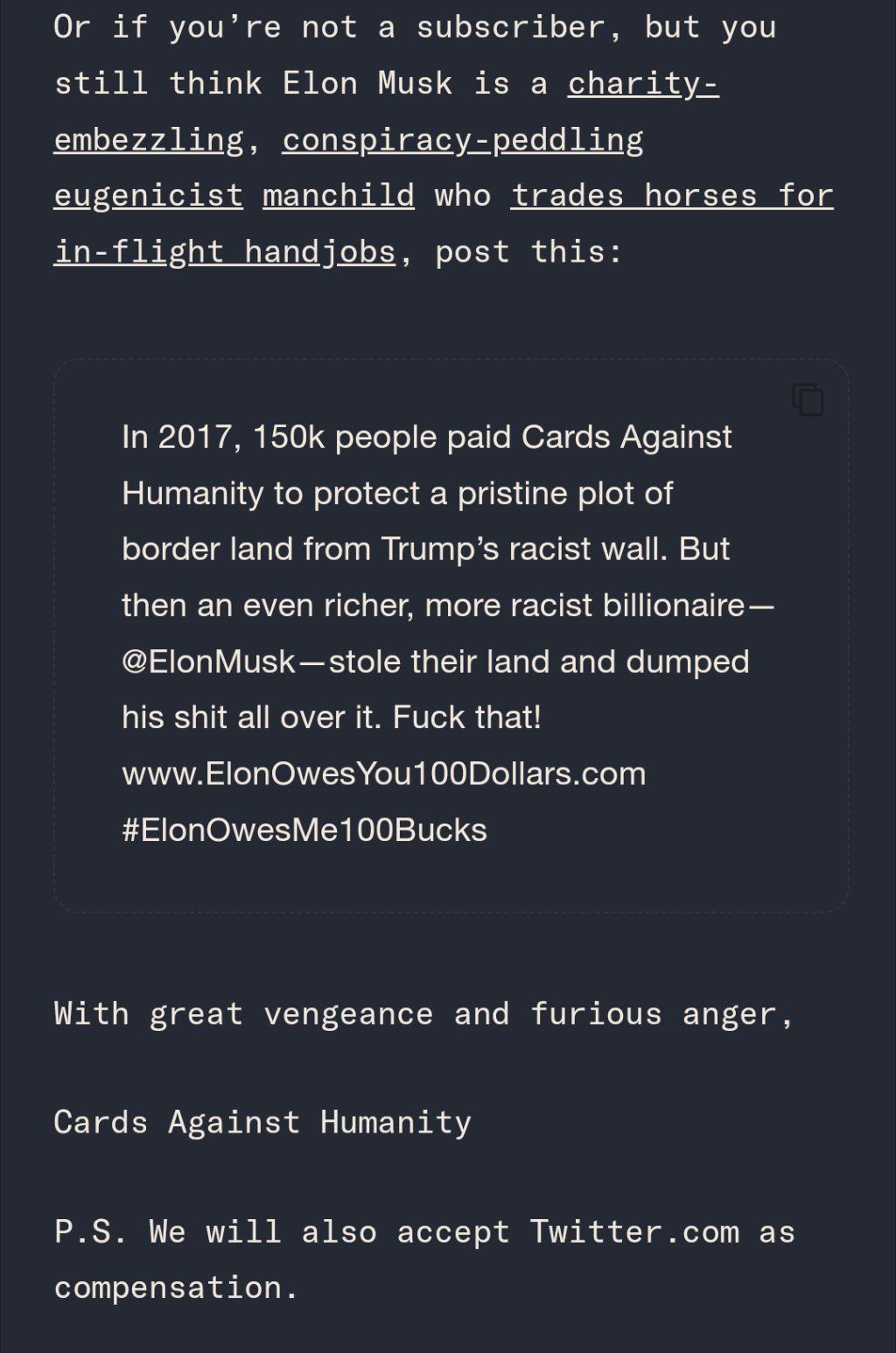

Getting twitter.com redirecting to cardsagainsthumanity.com would certainly be worth 15 million. Ha!

Maybe he’ll get fined enough by the FAA for SpaceX violations and SEC for missing court appointed meetings he’ll decide to just give up twitter and go back to digging holes underground. Unlikely I know but good for a laugh.

4 fingers?

https://github.com/deniscerri/ytdlnis can queue and more, might take a look.

In general I don’t disagree that CNN a corporation which has a fiduciary bias to it’s peers in the news it promotes. That is a bias of corporate person hood.

Many other issues there, but I’m curious on a spectrum in the US and in comparison to other similar organization in the US, how you would place CNN? Right leaning? Center? Far right?

Ah so you have a methodology, which is experience based, uses your individual knowledge? Can you explain how you judge political bias, so others can use it?

I applaud your interest in self-reliance, but how do you determined you are not being manipulated by either side?

It’s getting it’s info from Media Bias Fact Check so explain to me how their method is wrong? You prefer All Sides. Or Ad Fontes Media? Both of which also say leaning left.

Indeed, Russia still has some currency reserves, the shadow gas fleet, huge increase in domestic production of arms, and has some how kept it’s GDP growth up. Not that it doesn’t have issues on it’s horizon, but time is still there to wiggle around them. Also you are correct about Ukraine, many reasons to be enthusiastic, but Winter still looks like it might be rough.

And Trump, well yea still many days to the election and he may yet pull Vance’s thumb out of his ass. Can’t say I don’t like the nice poll numbers from swing states though, seems like Harris has some good appeal to the swing voters.

Looks like it had some anti-drone mods which clearly didn’t entirely work. Curious if that become a total wreck or recoverable wreck.

What they should and what they will being entirely separate of course, but I agree they should take it away irrespective of if he keeps his diplomatic and etc. It would be a good sign of not being above the law, like he’s trying to be.

Just have a think talks a bit about this as well.