- cross-posted to:

- economics@lemmy.ml

Giving insatiable vampires more and more wasn’t a good plaaaaaaaaaaaan!

Not going through the WSJ comments, but it’s obvious how the problems with China’s approach will be dealt with should push come to shove after you’ve gone through the article.

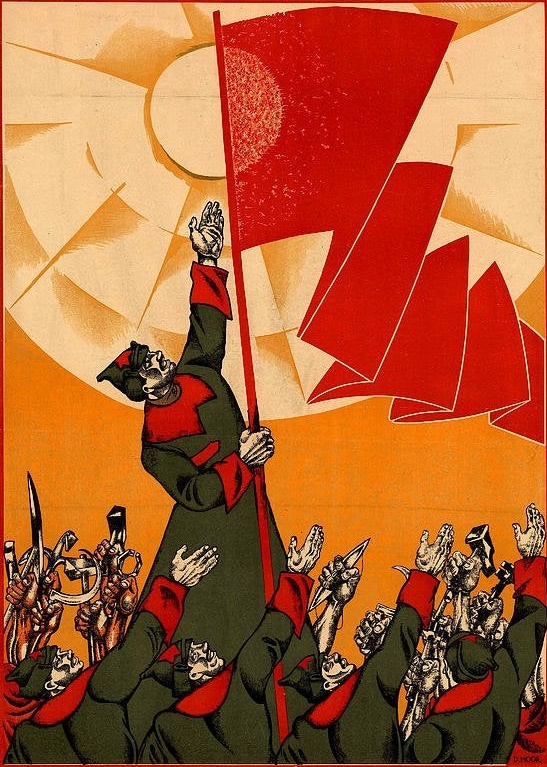

China is a Communist state running a capitalist simulacra. The highest state of capitalism is imperialism, and the highest state of simulated capitalism is simulated imperialism.

If the trade barriers come up, for a lot of goods, China can effectively just increase military spending (currently at 1.3% of GDP official, or 1.7% according to SIPRI, compare 3%, 3.3%, and 6.8%, depending on who you trust, in the United States) to absorb excess capacity.

The problem with a lot of our concerns (genocide of Palestinians in Gaza, the mutual slaughter in Ukraine) is that the Chinese, in both cases, can get off their asses and intervene more aggressively. But they don’t, because they have trade ties with the West and still need to grow their economy. If a new Iron Curtain were to form, however, there’d be nothing stopping them from taking a harsh anti-Western position geopolitically.

Simulated imperialism essentially comes down to the anti-Western bloc having sufficient power to say: stop, this is stupid, or stop, this is obscene, and the West actually has to sit down and listen because it no longer has monopoly control of the world’s hard and financial power.

A second factor is capital goods exports. If China is cut off from the West through direct trade, there are a bunch of non-aligned countries that can import low-cost Chinese capital goods, then export them to Western consumers at lower prices than if the West were to sell the capital goods themselves.

Where these two things essentially combine is in greentech: this isn’t often mentioned in Western media, but the cost of Chinese battery storage is down to 5.6 cents per watt, or an effective cost of 2-3 cents per kWh generated. Chinese solar installed costs, at the largest scales, is currently about 20 cents per watt, which translates to half a cent or 1 cent per kWh of raw electricity.

Or, in other words, batt + solar is cheaper than frackgas or coal for new power generation. This essentially comes down to a neoconservative excuse to force countries off American frackgas or Western nuclear and make them buy solar + batt.

and the West actually has to sit down and listen because it no longer has monopoly control of the world’s hard and financial power.

there is no way the current generation of western leaders ever do this. no chance at all.

they’ll burn the world to ash before they’ll consider listening to people they consider subhuman.

I think that western leaders are very willing to sit down at the discussion table, but that isn’t a good thing. This gives the west more opportunities and excuses to undercut and wage psychological and material warfare and sanctions against the Global South. The west isn’t as “insane” as it appears, and that’s not entirely a good thing.

oh they’ll sit down, sure. what they wont do is listen.

I think the west will listen enough to make it seem like they are willing to play ball, but they will dismiss the forest for the trees and act like they are benevolent colonizers.

Long article, some good data, then they end it with this gem:

“Everybody makes stuff in China,” said Joerg Wuttke, former president of the European Chamber of Commerce in China and now a partner at Washington consulting firm DGA Group. “But nobody makes money.”

I guess it’s self-evident to everyone but me what he means.

You have to produce in China to keep costs down, but you can’t sell effectively in China due to state-mandated hypercompetition driving everyone to zero profit.

Turns out Communists are better at capitalism than capitalists are.

Competition is one of those capitalist buzzwords they use to reinforce their Darwinian beliefs, but as it transpires they don’t actually like it that much

Much like anybody else that is involved in competition of any sort, they only like it when they’re winning.

In comp games (not like… Competitive ladders and elo, but just playing against a human opponent) I am trying to excise that reaction in myself. Its very important for tabletop gaming community health. I will say if my opponent is being a smug asshole joyously celebrating their good luck even when they’re obvious already winning, it makes it rather difficult. Co-op for life, apparently.

I frequently contemplate that about games, and the idea of ‘friendly competition’, but in truth I don’t think such a thing really exists. I imagine a group of friends, say 6 people or so, and all of them enjoy Street Fighter. One of the 6 is doubtlessly going to be the worst in the group, and will rarely ever see wins. Even if the other 5 are very kind and gracious to their friend, could it really be said that the worst in the group will feel good about playing the game? About being the well-treated punching bag? I doubt it. The process of competition itself, even when ‘friendly’, is deleterious to the loser.

I think friendly competition definitely exists, and it’s a cornerstone of human psychology. But in order for friendly competition to work, everyone has to “win” at least some of the time.

“Real eyes,” said Joerg Wuttke, former president of the European Chamber of Commerce in China and now a partner at Washington consulting firm DGA Group. “Realize real lies.”

“How can mirrors be real,” said Joerg Wuttke, former president of the European Chamber of Commerce in China and now a partner at Washington consulting firm DGA Group. “If our eyes aren’t real”

If y’all don’t leave Jaden alone 😂😂😂😂😂😂😂😂😂😂😂😂😂😂😂😂😂😂

No shade I love that it’s become a meme lol, I get what he meant to say

anal eyes analyse anal lies

😂

He is probably saying that they overproduce stuff, which drives down prices and profit.

🎻

Everyone just makes stuff for fun in China!

Sucks to be Joerg who only makes stuff for money.

Amazing to see how the article repeatedly points out that this shift in Chinese policy is driven by western belligerent (and genocidal attacks in the middle East, giving rise to global fear, which the article doesn’t notice).

They straight up say that Xi was willing to tackle “overcapacity” (such a thing does not exist) up until recent years where the western countries showed that they have no interest peace.

Still the blame lies with China somehow.

overcapacity is a cia propaganda term like authoritarianism and “liberal world order”.

they basically redefined any EXPORTS as overcapacity. lmao“Overcapacity is when we can’t sell things at as high a price as we’d like”

I love how they keep trying to frame it as a problem with the Chinese model and subsidies as opposed to asking what prevents other countries from doing the same. Seems to me that the real question is why western countries aren’t able to compete with China on price and quality of products. It’s as if the market model the west keeps peddling is being proven to be far less efficient than state driven central planning.

We don’t use slave labour and toxic plastics.

👆 how to out oneself as an utter dumb fuck

The US is the largest slave owning state in the world and its plastic industry (the petroleum industry) is effectively unregulated.

Where do you get your information about the world around you from?

Lmao literally just look up the 13th amendment

At this point I’m not sure the west could plan things centrally and succeed. They would have to go through several cycles of trial and error. China has been building it’s capacity for decades. And it benefits from its democratic centralism/SWCC/Marxism. Then again companies like Amazon can manage it…

Not only that, but I don’t think that it would even be possible under the current system run by financial capital. You’d need fundamental systemic change to even attempt it.

Huh, perhaps labor is the superior of capital?

it’s not even about labour and capital at this point. West doesn’t have much capital at this point. A lot of it is just money that exists in databases and spreadsheets, along with the war machinery that forces the rest of the west to pretend its real.

The West has de-industrialized to a large extent, but it also has financial instruments which it uses to extract superprofits from its neocolonies in the Global South. That “money” that exists in databases and spreadsheets allows them to underdevelop the rest of the world, control the primary production of raw resources, and restrict the movement of advanced technology outside the West.

Although the murder machines definitely help turn those financial instruments into real tools of underdevelopment.

I was more referring to the fact how the USD is not backed by anything material. Vibes based currency.

But who will innovate with LED car tunnels and Mechanical Turk gimmicks?

Late-capitalist “”“innovation”“” really is a marvel - so much time and energy and labor invested into gimmicky nonsense that doesn’t actually technologically advance society because capitalists fundamentally do not understand how innovation actually creates progress. It’s just:

- Innovate

- ???

- Progress!

They’re completely mystified. It’s incredible.

So much bazingamobile babbling can directly be beaten, if only the bazingas would listen, with “MASS TRANSIT IS BETTER. STOP AVOIDING IT.”

Bazingas have reached a level of hyperalienation that has alienated them from humanity itself. They want their own personal transportation pods because they would rather destroy the world and literally die than sit next to someone on a train.

Bazingas have reached a level of hyperalienation that has alienated them from humanity itself.

It started with private jets and executive elevators. Now it’s fever dreams of fleeing to Mars or even “escaping the simulation.” They’re afraid and miserable, even while on top of the system gradually killing us all.

or even “escaping the simulation.”

The classic log out method is right there

I am always like two last nerves from invoking LowTierGod at bazingas at this juncture of time and space, I wouldn’t even bat an eyelash telling a techbro to an hero themselves anymore

bazinga

You called?

How can there exist “overcapacity” in a world where so many people are poor and so much production still has to be done to transition to clean technologies?

“Overcapacity” just means “We can’t sell things at as inflated of a price as we’d like to”

I am always caught off guard with this genre of reporting.

Since then, China has nearly doubled its output of silicon wafers, way more than it needs. The extra wafers had to go somewhere—and they went overseas, pushing prices down by 70%.

Do… do you not know how international trade works?

Do… do you not know how international trade works?

Of course they don’t, it’s the Wall Street Journal

They are incapable of having a coherent view of economicsI’m 99 percent sure they do know how trade works, they are just spinning this as a negative because Amerikkkans have been conditioned to accept hypocrisy and racism, and to throw a fit when the Amerikkkan colonialist empire is unable to sufficiently profit off of something.

The greatest thing about capitalism is infinite competition. Ok wait no you’re competing too good stop STOP

I’m 99 percent sure they do know how trade works, they are just spinning this as a negative because Amerikkkans have been conditioned to accept hypocrisy and racism, and to throw a fit when the Amerikkkan colonialist empire is unable to sufficiently profit off of something.

lol right, the whole framing is just so surreal

Price down is … bad now? Just pay extra then and call it a tip!

The West has built itself an economy based on services and speculation. Meaning it’s backed by nothing, other than imaginary concepts. So when the prices of tangible goods go down, the few EU/US/UK industries that use/produce them suddenly have to lower prices as they can’t compete. If they lower prices, their stock goes down. If their stock goes down, then the whole speculation sector deflates in value. If the speculation sector loses value, the western economies collapse.

There’s a similar worry with the price of steel (which is also “overproduced” by China after diminishing its construction sector), and don’t forget the recent tarrifs imposed on EVs and renewable resources exported by China as well.

There’s wider implications on the West caused by price cuts:

-

less profits for the capitalist class

-

line doesn’t go up exponentially any more

-

the global south suddenly has viable alternatives to importing high-tech and manufactured goods

-

the financial instruments used to keep the global south down are no longer effective

I think it is more accurate to say that most western economies are dominated by monopolies, which are themselves controlled by hedge funds and the like. The Hedge funds blindly chase profit with little to no regard what enterprise they are actually investing in. This works so long as the productive enterprises holding up western economies (heavy industries, sectors critical to national security) are profitable from their monopoly status (upheld by patents, subsidies and high barriers of entry). But as soon as western economies start facing external competition, their monopolies loose profits, the hedge funds retract investments in western monopolies, and the whole game starts unraveling.

None of those implications are bad UNLESS you are a manufacturer of those goods in the West. Or investing in those manufacturers. This is where WSJ falls flat on its ass.

The rest of the economy is a consumer of those cheaper goods. So the discounts on those goods makes the wallet go further. That’s good for consumption. Consumers might even throw more money towards those dogshit services that economists are now in love with.

The way the western economy is tied together through stock markets though means that one company or hedge fund failing because one manufacturer goes down, will cause a domino effect (either due to panic or interconnected stocks). That’s the fear anyway. We’ve seen exactly that when Intel’s stock went down, which was only mitigated by the Fed printing money and silently propping up the stock market.

I agree the stock market is a big influence of the economy. Stocks are massively overvalued. There’s not enough available cash in existence if there’s big sell off on a major stock like Intel. Hence the need to print money. If the Fed didn’t intervene, that illusion of stocks actually having cash value would vaporise.

-