An interesting idea for sure and certainly has meaningful implications—maybe, it’s not like I’m an expert—before it reaches the ‘sweet checkmate’ territory I think the author has in mind, but if any significant indication exists that China is directly undermining the US dollar in such an effective and apparent way, I fear it’s WW3 before the strategy comes to fruition.

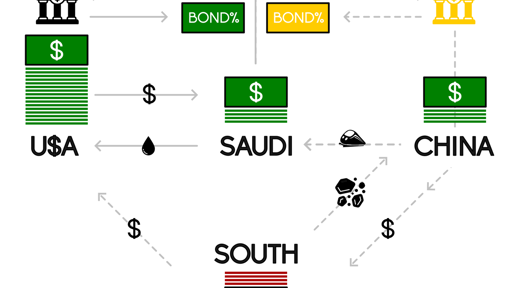

The specific process of this matter can be simplified as follows: we borrow US dollars from Saudi Arabia and then “give” them to a third country. The third country repays the US debt and gives us resources. We give Saudi Arabia high-tech products. The US dollars from the third world are accelerated to flow back to the United States, and the US dollar inflation, in turn, accelerates Saudi Arabia’s “borrowing” of US dollars… forming a perfect cycle. Saudi Arabia sells dollars, we get resources, third world countries pay back U.S. debts, Saudi Arabia gets high-tech products, and the United States “gets” dollars… It’s a win-win situation for all parties, and the whole world wins.

As someone who likes a good plan, specially when it’s being petty or returning something to someone who wronged you, I really like the sound of this. lol

awesome article, basically only dollars repaid from debt flow back to the US in this hypothetical framework.

Yep, the “petrodollar” is broken once the Saudis stop buying US Treasuries.