Hey, I was wondering if someone needs credit to buy things. People in my family have said I wouldn’t be able to buy a car or a house without credit. But if I’m saving up cash to pay for things outright, do I really need credit?

Note: I’m sorry if this is the wrong place to ask.

Depends a little by country. If you can save enough money to buy a house, car, and anything else that costs a lot upfront, you don’t need credit.

But in some places, houses are prohibitively expensive and a very small percentage of the population can save up enough money to buy a house by the age that they want to buy it at. If it takes until you’re 45 years old before you can save up enough and you really want to have a house by 32, then it could make sense to buy it on a loan at 32 and pay it off by 48 or something.

If you end up needing to do that, a good credit score will get you a lower interest rate on the loan.

There’s also the question of what about things you have to pay immediately even if you don’t have the money. Example: you get in a car accident and now you have high medical bills (if American) and damage costs if the damage you do is higher than what your insurance covers. You might need to take a loan to pay for all that and a good credit score gives you lower interest rates.

Pretty much, yeah. You can probably save up to buy a cheap used car, and you may be able to save up to buy a new car, but you definitely won’t be able to just pay cash for a house unless you’ve got so much money the rules of personal finance are totally different.

You also need good credit to rent most apartments and to get many kinds of jobs.

I’ve created a plan to save $1,000-$2,000 every month for 25-30 years at a realistic interest rate of 2-3%. By the end of it, I’d have around $886,389.54.

And the cost of buying a house could continue to skyrocket the entire time. In 30 years that could be a nice down payment, but you’ll want good credit, too.

That’s great, but that entire time you’ve (assumably) been paying rent. You’ve saved up enough to buy a house for cash, but also spent enough to buy an entire second home.

You’d stand to gain significantly if you bought the house earlier. Rent paid is burnt, but a mortgage paid is building equity in your hone.

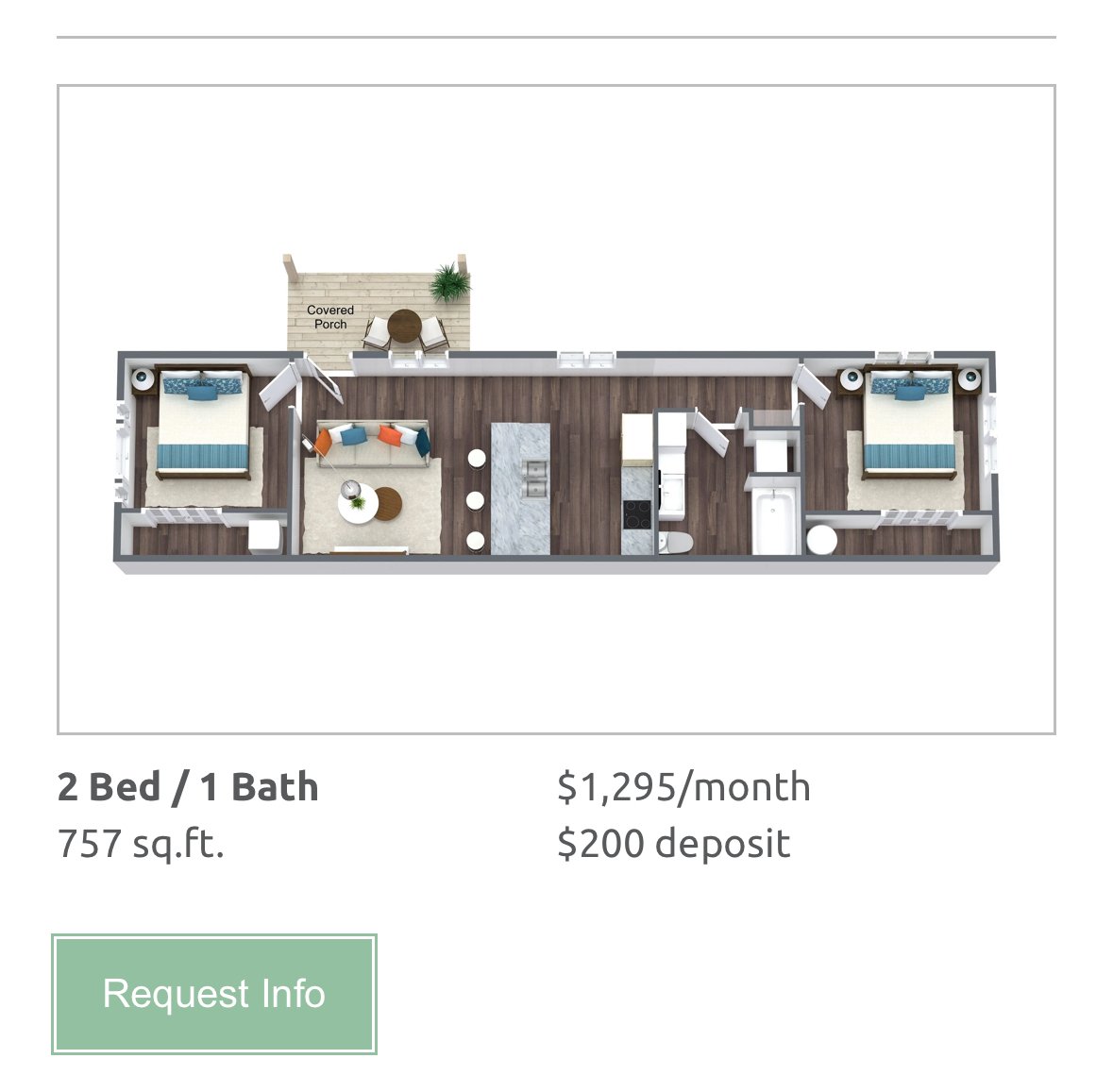

It’s a really nice place, and I want it. It’s in a higher median economic class within my state, and I aim to succeed and elevate myself into Royal society, you know? It’s like a game to me: you work, earn enough money, and beat each economic level. Then, you move to another state, and even if you’ve conquered every level in one state, you might have to start at the bottom or middle in a more expensive state.

It’s a really nice place, and I want it. It’s in a higher median economic class within my state, and I aim to succeed and elevate myself into Royal society, you know? It’s like a game to me: you work, earn enough money, and beat each economic level. Then, you move to another state, and even if you’ve conquered every level in one state, you might have to start at the bottom or middle in a more expensive state.

Also something to realize is that buying things on credit isn’t always a bad thing. If you have $30,000 to buy a car, and get 0% financing, you can do a lot with the rest of that cash while paying off the car. (as long as you don’t miss any payments, or do anything that will charge you fees)

Buying things with a credit card can also protect you from problems, many credit cards have strong fraud and warranty protection.

Keeping a credit card for emergency purchases that you may not have the immediate cash for can also be helpful, as long as you do it responsibly.

Wealthy people use loans, credit, and delayed payments to maximize their portfolio.

You don’t absolutely need credit, no. But it’s sometimes more efficient (financially) to buy things on credit.

Housing is a typical example of this. To save up for the full price of a house will likely take someone years (at least 10, likely more). In that time, you’re (probably) paying rent and not accumulating any net worth for doing so. In contrast if you buy a house on credit (mortgage) you may be paying almost the same amount in mortgage & insurance as you would for an equivalent rent; but at the end of the ~10 years you’ll finish the loan and have a paid off house. If instead you spent all that money on rent, you’d have only the amount saved in addition to the rent paid.

There’s many online rent or mortgage calculators to show when it’s a financial benefit to hold a property on mortgage as opposed to rent & save any difference… it is not always the case that owning your housing is more financially efficient; but for many people it is.

Similar with a car; if you need a car for your income (e.g. your commute isn’t feasible nor reliable via other transportation means); you can’t save up for a car with income you require a car to earn. Of course, this is why many advocate for better transit options and to move away from car-centric cities and lifestyles. But not everyone is able to achieve a car-free life (especially in much of the US).

The other big reason to use credit: you often get real benefits for doing so! Paying in cash occasionally offers a discount; but that’s only the case at a minority of places. In most cases you can pay the same price with either credit or cash, but also receive some benefit from the credit company (e.g. miles, points, cash-back, etc… your card options will vary). Why is this the case? The current state (in the US) is that credit card companies make money on transaction fees to merchants. In order for one card company to encourage you to use their card over a competitor’s they offer some form of incentive. The merchant’s transaction fee is why you’ll sometimes see merchants offer a cash discount; and if that’s the case you’re often better off paying cash. But when price is the same for credit or cash, you’re leaving money on the table by choosing cash (or rather, you’re giving some percentage of your purchase to the merchant instead of splitting it with the credit card vendor).

Your points are good, but you’ve overstated the equity building of a mortgage. You aren’t likely to find a 10yr mortgage that is the same as rent. In a more typical situation, after 10 years on a 30 year mortgage you’ll have 20% equity. Or after 10 years with a 15yr mortgage you’ll have 65% equity.

One of the biggest advantages of mortgages, at least in the US, is in getting a fixed rate. Rents can easily double in the time before you finish paying off a mortgage, but a fixed rate mortgage wont go up. Property tax and insurance can go up, but those costs would be rolled into rent anyway.

Fair point; I was throwing around off-the-cuff numbers. You’re right that 15 or 30 year mortgages are the time frames to calculate around.

The inflation adjustment is valid too. If rates drop refinance options are available at the mortgage holder’s convenience (assuming their terms allow it, but most do); but taking advantage of decreasing rent often requires a move; not nearly as easy as a purely paperwork based refinance.

My mindset is still stuck in the 2010s; when inflation was mild & rates were at historic lows for nearly the entire decade.

This account’s post history is a fucking WILD ride.

Yeah, I hear that a lot, but my personality is more of a wild ride. If you knew me in real life, you’d either be scared of me or think I’m a blast to be around, no matter how psychotic I can get.

Yeah no, from your post history, you’re a habitual liar full of attention seeking behavior. You say outrageous things in the hope that it’ll get people to respond. That’s not “scary” or a “blast” it’s annoying, like an adult who should know better acting like a five year old.

Honestly, that’s the funny part. I have rarely, if ever, lied in the past few years. I just don’t see the point. If people don’t wish to accept me or don’t like what I do, I don’t exactly care. Sometimes, it’s fun to keep the argument going. But yeah, that’s not all I was getting at. I do meet the psychopathic spectrum, which has deeply influenced my life. I see the world and perceive what’s right and wrong drastically differently. Also, if you think what I’ve said here is what I’m talking about, no. It’s what I say on a day-to-day basis that can be absolutely out of this world gruesome and insane but that also opens the door for crazier ideas and more fun, including taking bigger risks. While it’s true that the portrayal of psychopaths in media often focuses on a lack of empathy or emotion, the reality is more nuanced. Psychopaths can indeed experience a range of emotions, though they might feel or express them differently. For me, while I used to feel a broad spectrum of emotions, I now mostly experience love and negative feelings. Since the only positive emotion I experience is love, it has significantly amplified both the depth of love I feel and the amount I can give to others. Now that I think about it, it’s always been that way. My favorite thing is ensuring others don’t go through what I experienced.

Please talk to a licensed medical professional and take a break from the internet until you get better.

Honestly, that’s the funny part. I have rarely, if ever, lied in the past few years.

Then you’ve been going through a psychological break and posting things with zero connection to reality. That’s not better, that’s worse.

I find it perplexing that some perceive what I share as disconnected from reality. Everything I post reflects my current life experiences, including my personal growth and related developments. My medical team is aware of these experiences, and they are corroborated by others who have witnessed them.

Regarding the capacity to love, it is a frequent topic of discussion. Why should there be a limit to the number of people one can love or care for? The idea of restricting this capacity to just two or four people seems arbitrary and unnecessary.

I have consulted both a psychiatrist and a therapist. Both professionals have confirmed that my experiences and thought processes differ significantly from those associated with psychological breaks or schizophrenia, contrary to some family members’ concerns.

Not gonna answer this, could easily pick out the lies in this comment just from comparing to your post history, I think I understand fully now why involuntary commitment exists.

“It’s fascinating how you suggest that comparing my comment to my post history would effortlessly reveal any inaccuracies. It seems you’re making quite a statement but holding back on the specifics. If you’re as insightful as you claim, why not share your findings with the rest of us?”

“You seem to have a few points in mind. Now something you may say. While I’m currently in no position to consult professionals due to finances, that doesn’t mean I haven’t done so in the past. What else can you come up with? Please, enlighten us, ‘genius.’”

But if I’m saving up cash to pay for things outright, do I really need credit?

No. If you have enough cash to buy things outright, then you don’t need credit to buy things.

On the other hand, you do need a credit score to rent an apartment, or to qualify for a mortgage. (If you have no credit history, but have proof of income, some landlords will risk renting to you.) Since most people can’t ever afford to buy a house with cash–a mortgage is a form of credit, albeit not revolving credit–and certainly can’t do so without renting a place in the meantime, that could make things challenging for you.

OTOH, if you’re disciplined, then having and using revolving credit accounts can be a net positive. For instance, certain credit cards give you ‘cash back’, such as .5% of all of your purchases. As long as you pay your card off every single month, and never, ever float a balance, then that ‘cash back’ is effectively a .5% discount on everything you’ve used that credit account for. It also means that you have a reserve of sorts to deal with genuine emergencies where you may not have liquid cash on hand.

I’m very much in the camp of having, but still hating, credit cards.

Yeah I’ve seen that with apartments so far it’s kinda a 60/40 if they check. Though I wish I could pay 3-4x the rent first month to counteract credit.

Plus the “rewards” from credit companies are paid for by merchants leading to price adjustments for all items regardless of payment method. If you aren’t using a credit card you are paying me to use one.

Even renting a place these days requires a credit check. So unfortunately, yes.

That is somewhat annoying like why can’t someone just make enough but understandable 🥲

Sometimes you need good credit to rent apartments, so that’s one example where you can have enough income (and even certify with proof on a rental application) yet you’ll still need good credit.

For an apartment could I pay like 3-4x the rent the first month to counteract not having credit?

That just depends on the landlord and what they want to allow - in a competitive market they have tons of applicants with decent credit who are willing to put down multiple times rent, so it doesn’t make sense for them to go with a person without credit. One apartment I lived at required a security deposit and last months rent in addition to first month, which makes 3x the rent and they still required and rejected tenants for bad credit (as well as illegally i think requiring an application fee for a bit for replacement roommates before we pointed out that it seemed illegal, if that gives any indication of what typical landlords were asking for and tenants willing to put up with). They did allow cosigning though so one of my roommates had their parents cosign, it just means their parents had to pass the credit check as well as being legally on the hook. That was in the Boston area though so maybe that’s a worse area for finding a rental than others, and you’ll probably find a few lax landlords here and there who care less, but passing a credit check helps a lot.

It’s also nice not having to send 5-10 prospective apartment applications to your parents to co-sign in case any of them get accepted - which I had to do for my first apartment because I had a “thin credit file” for a bit since I was getting started with credit.

And I think 6 months later I had enough credit history to pass the check on my next apartment, so it doesn’t take much. I just accept most credit card offers that don’t have annual fees, enable auto pay, and stick them all in a box. Every once in a while I buy something at the grocery store on one of them to keep them from being closed due to inactivity (like 4 out of 5 of them don’t even care about inactivity so they stay in the box), and now my credit is great. For the most part, I just ignore the credit cards. I only have them to have a credit score.

Depends on what you’re buying.

A $5,000 used car? Sure, you can save up for that.

A $40,000 new car? Good luck!

A $400,000 house? No chance without credit.

For me I planned to live off nearly 2.5 and put back about 1k to 2k every month on a 3% interest for 30 years.